Learn to Save Taxes on Your Trading Profits

August 6, 2025

In the fast-paced world of share trading, where profits and losses can swing dramatically, smart tax planning can significantly boost your net returns. If you’re a stock market trader dealing in Intraday or Futures & Options (F&O), understanding what expenses you can claim in your Income Tax Return (ITR) can help reduce your taxable income and legally save taxes.

Let’s explore how you can make the most of this benefit.

If you’re engaged in:

• Intraday Trading

• Futures & Options Trading (F&O)

…then you can claim eligible business-related expenses while computing your taxable income. This applies whether you follow the Old Tax Regime or the New Tax Regime.

This makes it crucial to report your business income and expenses accurately.

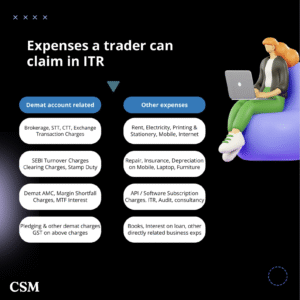

Here’s a sample list of expenses a trader can typically claim in the ITR:

| Expense Category | Examples |

| Internet & Phone Bills | Broadband used for trading activities |

| Brokerage Charges | Fees paid to brokers for executing trades |

| Software & Tools | Charting tools, trading platforms, analytics tools |

| Advisory/Consulting Charges | Subscriptions to trading advisories or analysts |

| Electricity | If a home office is used for trading |

| Office Rent | Applicable if a separate office is used |

| Depreciation | On laptops, phones, and office equipment |

| Education & Seminars | Trading courses or workshops attended |

| Books & Journals | Financial newspapers, magazines, or books |

| Bank Charges | Charges linked to your trading account |

Note: Keep proper invoices, payment proofs, and usage justification for all claimed expenses. This is crucial in case of an audit.

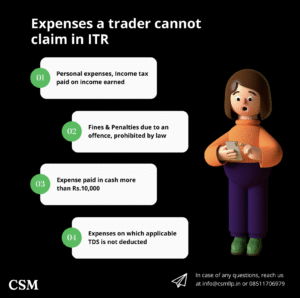

While many expenses are allowed, some are not claimable, such as:

• Personal expenses (e.g., personal phone bills, family subscriptions)

• Capital expenditures (unless depreciation is claimed)

• Any unrelated professional or personal expenses

Every saved rupee is an earned rupee. File smart, trade smarter!

Trading is not just about profits—it’s also about smart financial management. By claiming legitimate business expenses in your ITR, you’re not only reducing your tax outgo but also managing your business like a professional.

Disclaimer:

This article is for general informational purposes only and should not be considered professional advice. Please consult a qualified expert for advice tailored to your specific situation. The author and website owner are not liable for any errors or actions based on this content.